You must have come across disability news stories in the wake of the Covid aftermath. These have triggered disability concerns and the need for medical professionals and others to buy disability insurance coverage. Most people around us are supremely confident that disability is something that will not happen to them. However, research shows otherwise.

Almost 25% of today’s 20-year olds including those working on SEO in Plainview, NY will be unable to work for a year at least prior to reaching their retirement age. And this will be due to some form of disability or the other. This is why it becomes imperative to protect your income. You need to have access to funds even if you are out of work for a long time. But before you choose coverage, you should decide between long-term and short-term disability.

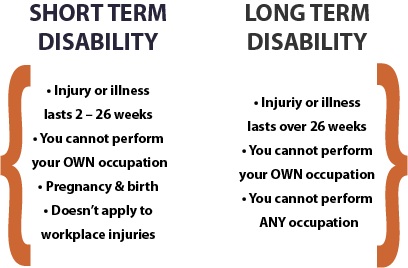

Short-term Vs Long-term Disability:

- Time-period: The first point of difference between STD and LTD is the time-period or benefit period. As the name suggests, STD is coverage for a shorter time-period. This disability insurance policy is meant to offer coverage for a while when you cannot work due to an injury or illness. STD typically covers an individual for 3-6 months, though policies can differ. LTD, however, is for long-term benefits and is stated in terms of years, 5, 10, or 20. You can even have LTD until retirement if your plan permits.

- Coverage: STD will typically provide about 60%-70% of your earnings. So, the coverage percentage is high. But LTD typically offers benefits equivalent to about 40%-70% of your earnings. Long-term coverage is for a longer period; so, the benefits amount is lower. To understand the extent of coverage you need, it is important to assess your monthly expenditure and additional medical bills that you may have to bear when you are injured or sick.

- Elimination period: STD will extend benefits within a few weeks after you have qualified for an injury or illness. LTD, however, has a longer waiting period. This is referred to as the “elimination period” before which you can start getting benefits. This period can be different in different policies, but it is usually 3 months. So, whenever you must choose between short-term and long-term coverage, you should consider expenses during this elimination period. Ideally, you must have access to an emergency fund or buy additional coverage for immediate protection.

- Miscellaneous factors: Apart from these above-mentioned differences, STD and LTD coverage prices can differ because of factors like health, occupation, age, location, and additional features. An emergency fund can cover your expenses during the time you are out of work. If you working in a marketing agency in Rhode Island and don’t have one, look for short term disability coverage. When you do have an emergency fund, it may be wise to opt for long term coverage. This could help you lead a comfortable life until retirement.

To know which the right choice of coverage is for you, it is best to talk to a broker advisor. Filing claims for LTD is a challenging, lengthy, and confusing process. Here, a disability insurance broker can help you understand the claims process and guide you through it.